Put your hand up if you love paying bills. Anybody? Nobody, right?

Somewhere there is a list of people who actually enjoy paying their bills and subscriptions. We’ve never seen it, but we're confident the list is short.

Regardless, we still need to pay our bills, so, when we do, at the very least, we should expect a bill pay experience that isn’t antiquated, clunky or inconvenient. One offering choice in how and when we pay. One where bills get paid instantaneously instead of taking days or weeks to settle. One with immediate biller confirmations instead of leaving us in the dark hoping we don’t get hit with a late fee. And is it too much to ask for a bill pay experience that offers bank-grade security without putting us through a convoluted login process that would stump the CIA?

We know most consumers want these things because last year we commissioned a study and it confirmed they are looking for a streamlined, consolidated bill pay experience that is fast, secure and easy to use.

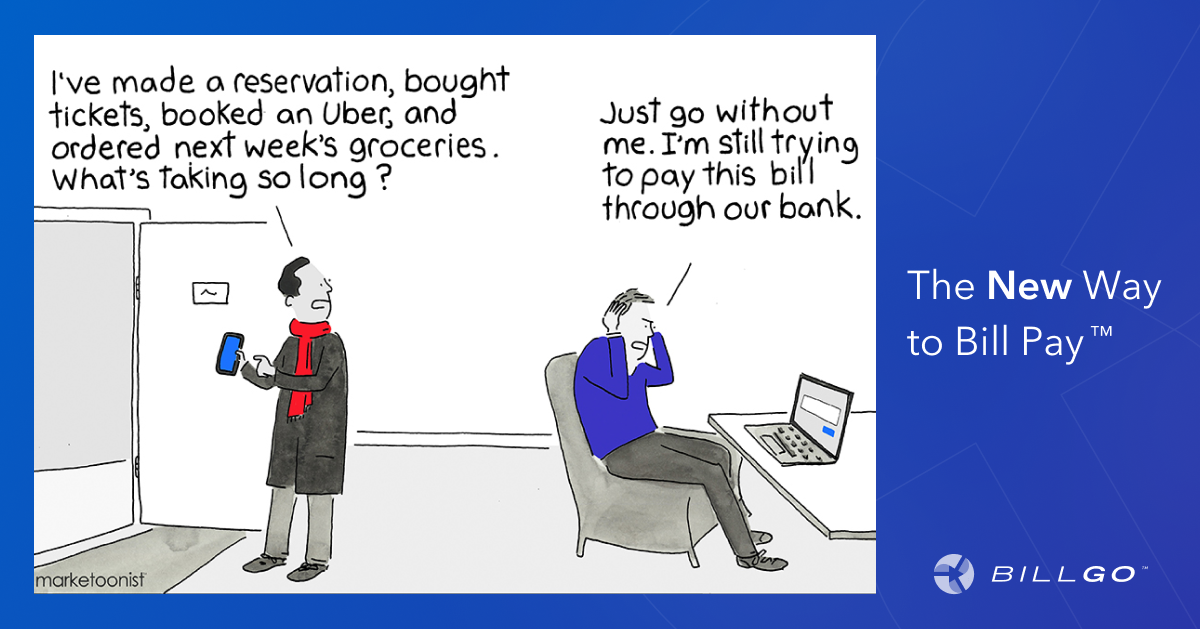

Because BillGO is all about the New Way to Bill Pay™, we thought we’d have a little fun at the expense of the friction that comes with using status quo, old-school bill bay technology. We asked Tom Fishburne, founder and CEO of Marketoonist, to get creative and illustrate the pain points that accompany the old way to bill pay.

Read on to see what Fishburne came up with.

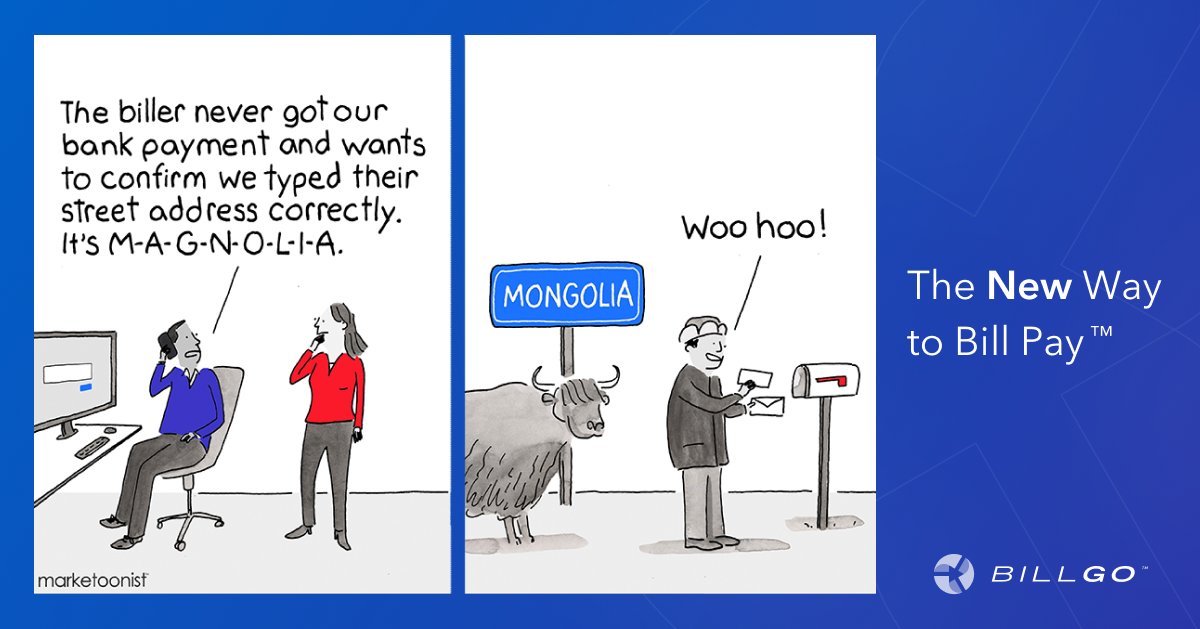

The Check is in the Mail? Seriously?

Millions of Americans continue to pay their bills by writing checks and dropping them in the mail. Not to sound judgmental here, but we just checked our calendar and it is the beginning of the third decade of the 21st century.

Remember the expression “the check’s in the mail”? Yeah, neither do most Millennials or Gen Zers. And who even keeps checks around anymore, not to mention envelopes or stamps?

Paying Bills Shouldn’t Be a Guessing Game

So, you grab a bite to eat, but you forget your wallet? No problem. Just log in to your banking app and transfer the money instantly. That was easy.

So, why is paying bills through your bank so cumbersome?

Because, in many cases, the bill pay technology most financial institutions (FIs) offer is more than 20 years old. While that tech was considered state of the art two decades ago (when BlackBerrys were all the rage), it is way out of step with the expectations of today's consumers.

Equally important, because so many Americans live paycheck to paycheck, paying bills in a timely manner is critical. Late fees have serious consequences and most old-school bank bill pay technology cannot guarantee timely payments.

Seriously, late fees are no laughing matter. Read how late payments can hurt your credit score.

Wait, Other People Want to Pay My Bills?

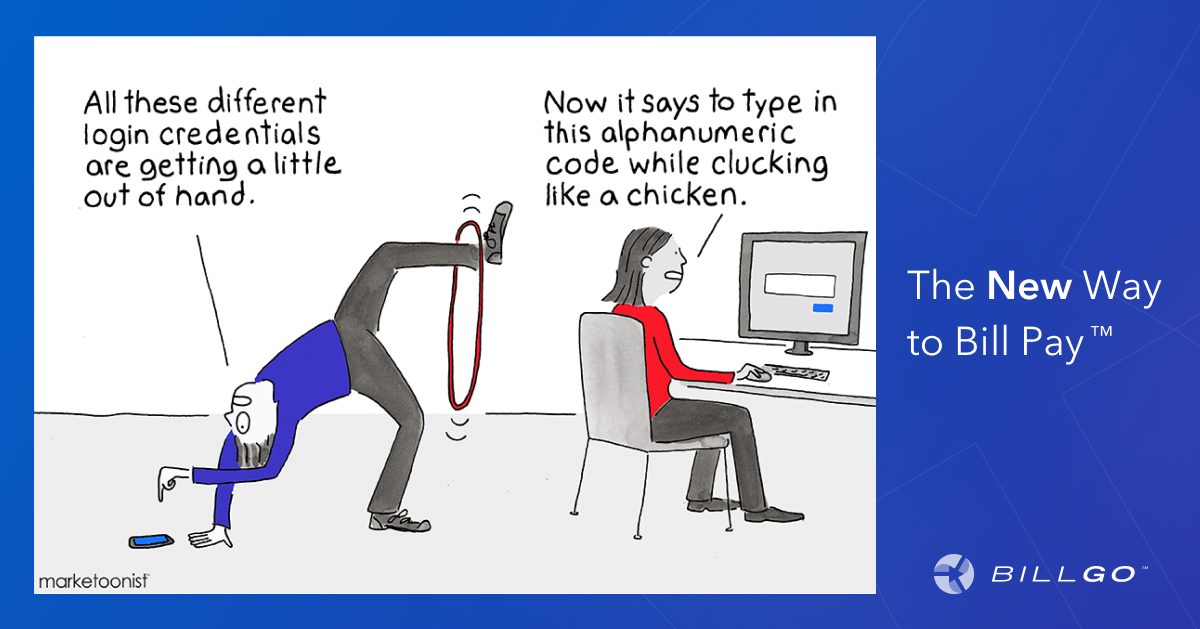

Logging in to pay your bills is more complicated than it needs to be.

To hear Kabir Singh tell it, it can be needlessly complicated. Singh scored some laughs sharing a conversation he had with customer service rep who demanded he confirm his identity to pay his bill:

Singh got a bill, called in to make a payment, when suddenly he was asked for his bill pay password.

“I don’t know what that is – let’s just pay this,” he said.

“I need your bill pay password to make sure it’s you,” the customer service agent demanded.

“Who’s out there paying other people’s bills?!” Singh screamed.

(Check out Singh's bit for yourself in this slightly-NSFW clip.)

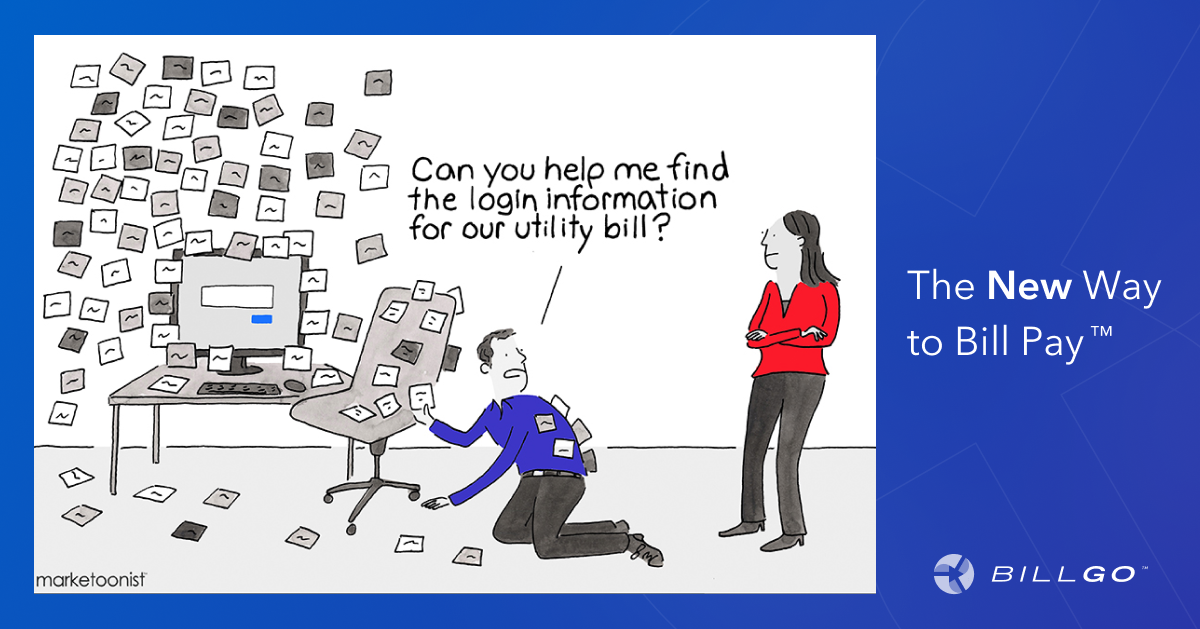

So Many Biller Sites; So Many Hassles

It's understanding why so many Americans are frustrated with shortcomings of the average bank bill pay platform. That's why most of them pay their bills directly to billers. But, not only does this require them to log on to an average of 15 different sites a month, it also automatically increases the amount of security risk they take on.

Each site requires a unique login and password. Yes, it’s a huge hassle, but it is also the kind of high-risk practice that keep cybersecurity professionals up at night.

Bill Pay Friction = Unhappy Customers

As we said, BillGO’s research confirms consumers like the convenience of choosing how and when they pay bills, but - given the hassles that come with juggling 15 passwords every month - it’s easy to see why they also want a secure, consolidated method to pay all their bills.

In the last 10 years, whether they are shopping, booking a ride or ordering a meal, consumers have come to expect a quick and convenient digital experience.

So, it’s only natural that - when paying bills - they expect the same.

When this expectation collides with the outdated bill pay technology offered by our trusted financial institutions, it’s understandable why even the most loyal customer might look elsewhere for a better bill pay experience.

And that’s no joke.