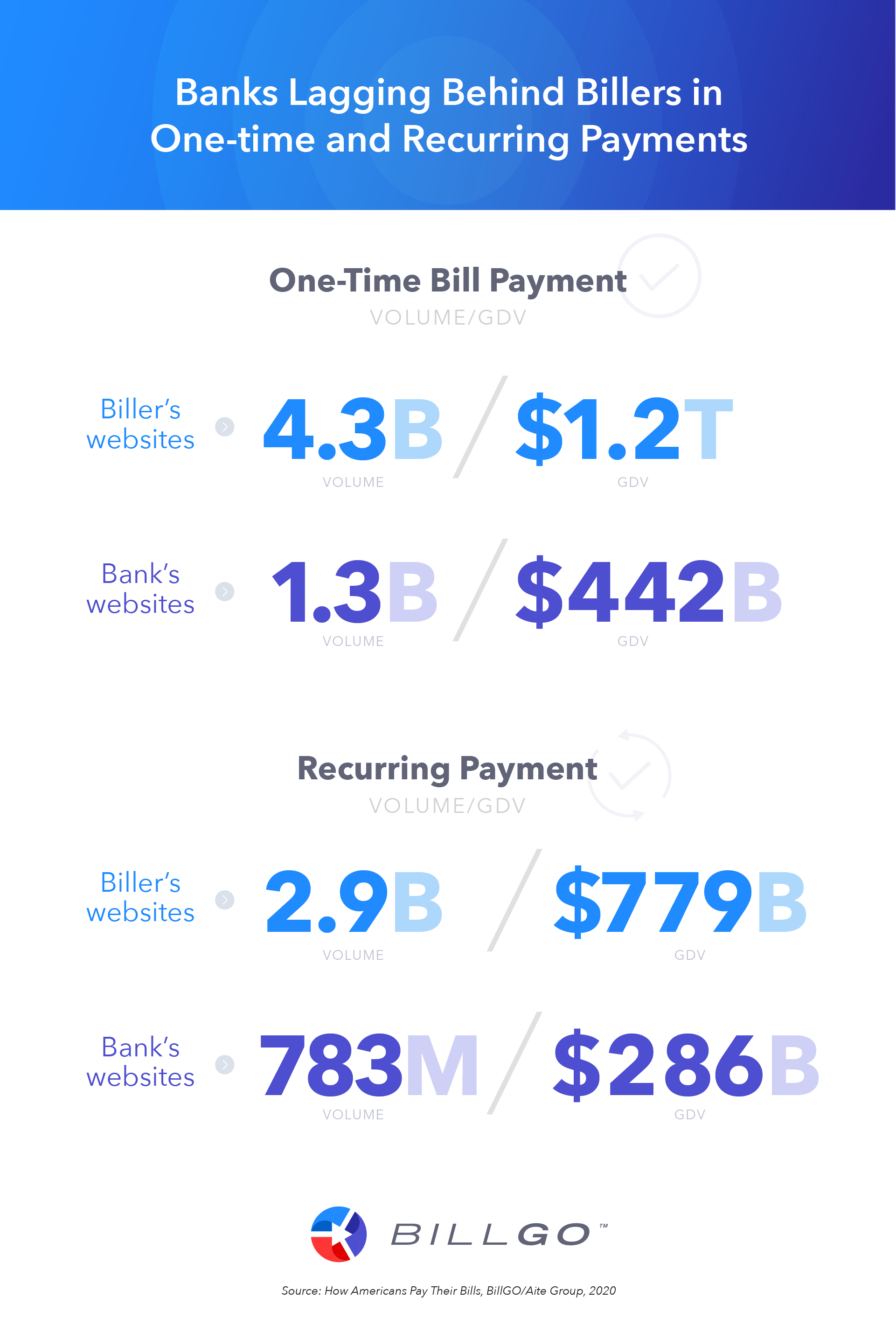

Among the 15.5 billion bills paid by US consumers in 2020, 62 percent were made online. Unfortunately for financial institutions (FIs), most of these online payments were made via biller websites.

This is one key takeaway from How Americans Pay Their Bills—a recent study by Aite Group commissioned by BillGO that underscores the widening gap between consumers’ bill pay preferences and the bill pay experience they encounter when logging into the bill pay platforms most FIs offer their customers.

The study confirms the percentage of online payments made on biller sites grew from 62 percent in 2010 to 76 percent in 2020; over the same period, bank bill pay declined from 38 percent to 22 percent.

Needless to say, this is bad news for FIs hoping to leverage their bill pay services to nurture lasting customer relationships.

Zachary Wasserman, Chief Financial Officer at Huntington National Bank, touched on this important benefit in BillGO’s recent Demystifying the Bill Pay Business Case webinar:

“By our analysis, it’s about 10 to 15 percent lower attrition when someone is signed up and engaged with you in bill pay, and you’re about twice as likely to be their primary bank to the extent that they are engaged in your bill pay.”

In other words, by providing customers with fully-optimized bank bill pay, it can open the door to long-term customer relationships.

To fully appreciate this opportunity and the steps required to transform bank bill pay, it helps to fully understand how the bank bill pay landscape evolved to where it is today and why consumers are gravitating to biller-direct payment options.

From Banks to Biller Sites: How We Got Here

Billers haven’t always had the upper hand on banks. In fact, there was a time when bank bill pay was so much better than the alternatives that customers willingly paid for the convenience of making bill payments through their bank. These fees drove a feedback loop of continuous improvement as FIs competed with one another to provide the bill pay features, capabilities and experience consumers demanded.

All of that changed when the fees went away.

According to Sara Grotta, Director of Debit and Alternative Products at Mercator Advisory Group, the migration from bank to biller sites began once banks introduced free bill pay making it the industry norm.

“As FIs dropped their fees, they stopped their investment in bill pay solutions in a big way,” Grotta explained in a recent BillGO webinar. “They saw bill pay more as an expense item and no longer as a differentiator.”

Billers, meanwhile, recognized the opportunity to gain an advantage over those FIs that settled for the status quo. According to Grotta, “[billers] took matters into their own hands and started to create better ways to pay bills on their websites. They worked to create that better experience for the bill payers which, in turn, improved their bill collection and engagement.”

FI executives agree.

In the Demystifying the Bill Pay Business Case webinar, Mark Sheehan, EVP, Director of Digital & Omnichannels at Huntington National Bank, explained the dichotomy between the necessity for bill pay and the interest FIs have paid in bill pay improvements.

According to Sheehan, although most financial services executives agree bill pay is an key component of their digital banking services, when asked, many admit their institutions have not invested heavily in bill pay improvements in recent years.

Consumer Bill Pay Preferences and Behaviors Driving Biller-Direct Market Share

When relying on most legacy bank bill pay platforms, consumers must typically chose to pay their bills either through their checking or savings accounts. In other words, many bank bill pay offerings fail to meet customer expectations.

“Many Americans today live paycheck to paycheck, and sometimes they have to—or want to—wait until the day the bill is due to make the payment,” says David Hadesty, Vice President of Business Development at BillGO. “So, biller-direct, with the ability to make a payment that day and receive confirmation, is very appealing to them where legacy bank bill pay typically has at minimum a one-day, if not longer, lead time.”

Hadesty’s assessment—drawn from 20-plus years of experience in the financial services industry—is supported by the Aite findings.

According to How Americans Pay Their Bills, 28 percent of consumers pay bills on or near payday, 14 percent pay bills on the due date and 7 percent pay bills “when they can,” regardless of when they are due. These findings suggest the need for faster payment capabilities to help consumers avoid missed payments and late fees, and in part explain why consumers prefer biller-direct as opposed to paying through their banks.

Although individual biller sites may provide the payment speed and choice consumers expect, the overall experience of having to visit multiple biller sites, enter multiple logins and navigate through multiple payment portals is far from ideal.

All things being equal, consumers would rather pay all their bills through a single, secure platform. And considering more than 80 percent of consumers around the globe say they are “happy” with their current bank, there is an undeniable opportunity for FIs to provide the singular bill-pay experience consumers want.

Key Features of Best-in-Class Bank Bill Pay

FIs wanting to bring customers back into the fold must focus on providing a truly modern bill pay experience. Features like quick biller setup, advanced bill presentment, real-time payments and instant payment confirmation can help FIs surpass the biller-direct experience within their own digital banking ecosystems.

How BillGO Helps Banks Win the Bill Pay Game

Driven by the core belief that everyone deserves access to a healthy financial future, BillGO’s award-winning real-time bill management & payments platform transforms the dreaded necessity of managing & paying bills into an opportunity for financial well-being.

Our technology serves more than 30 million consumers and thousands of financial institutions, fintechs and billers. BillGO combines speed, choice and intelligence with simple integration to change the way people make and receive bill payments. And thanks to our set of robust APIs and widgets, tailoring a bill pay experience to meet your customers’ needs has never been easier.

Contact us online if you have questions or would like to learn how BillGO helps leading financial institutions modernize their bill pay experience.